Gross Wages Report for Companies That Pays Their Employees by Hour for Ingress / TCMSv3

Introduction

The absence of payroll software in SME companies might cause difficulty for such companies to calculate wages of their employees. In some companies, they might have a combination of salaried employees as well as hourly employees. Hourly employees are paid based on hour and the pay for an hourly employee is usually calculated as total work hours multiply by the pay rate.

In Ingress software, there are more than 30 types of report available to cater for the requirements and the report to calculate the staff’s pay is the Gross Wages report. By using Ingress, the hourly employees are also eligible for overtime but some settings need to be configured as the steps given below.

Follow the steps below to generate a gross wages report.

1. Select pay rate

a. Ingress software > User Tab > Select User ID > Configure the Pay Rate

a. Ingress software > System Settings Tab > System Parameter Settings > Day Type > Configure the wages for

i. Workday / Holiday / Restday / Offday

ii. Work time / Overtime / Different Overtime

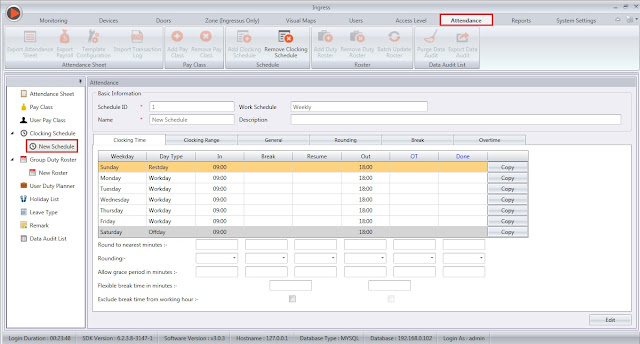

3. Create the clocking schedule

a. Clocking tab

i. Monday – Friday as Workday from 0900 – 1800

ii. Saturday as Offday from 0900 – 1800

iii. Sunday as Restday from 0900 – 1800

b. Overtime tab

i. Define time IN and OUT to treat as special OT from 2000 – 2300

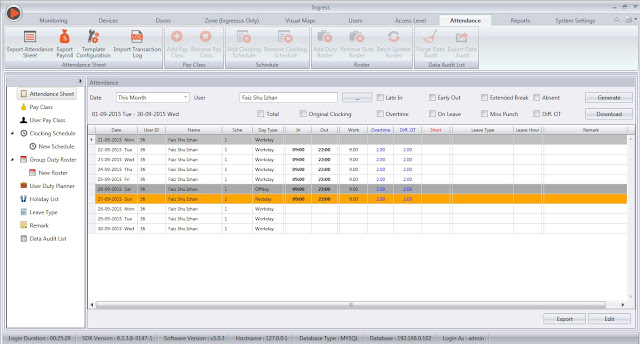

4. Generate the attendance sheet to apply new setting

5. Preview Gross Wages Report

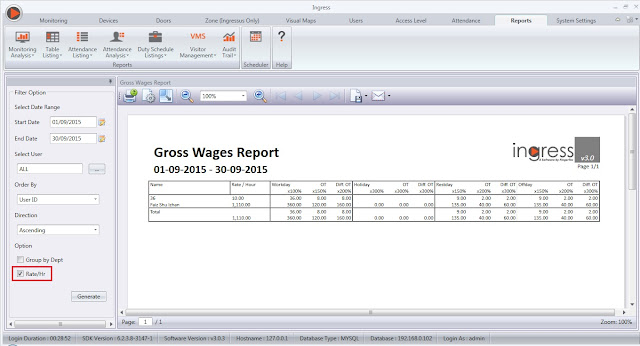

a. Ingress software > Report > Attendance Analysis > Gross Wages Report > Tick option

Rate per Hour.

Rate per Hour.

The report will provide you with all the hours observed which you can calculate based on the hourly rate to get the total of the amount in monetary value.

Note: If some of the screenshots or steps viewed here are different from the ones in the current system, this is due to our continuous effort to improve our system from time to time. Please notify us at info@timeteccloud.com, we will update it as soon as possible.

Related Articles

Gross Wages Report In Ingress & TCMS V3

Introduction Ingress & TCMS V3 are able to generate a report to calculate simple gross wages. You will need to configure in Ingress & TCMS V3 before you can make use of this report. Benefit Wages report will simplify management's task in order to ...Enabling Pay Rate display in 3 decimal places in Ingress/ TCMSv3 Software

Introduction FingerTec has recently introduced a new feature for Ingress and TCMS V3 software, where users can enable the Pay Rate display in 3 decimal places. It’s available in the latest Ingress v4.0.0.12 and TCMSv3 v3.0.0.11 . This enhancement ...Managing Employees with Multiple Time Zone Access to Multiple Doors In Ingress

Introduction In a real business operation, employees can access multiple doors within the company. To improve security, restriction of access need to be taken into great consideration. Managing access to key operational areas and restricted places is ...Send Personal Attendance Report to Dedicated Employee using Report Scheduler – Software Ingress / TCMSv3

Introduction Referring to the previous article about setting a Report Scheduler: https://www.fingertectips.com/2015/06/ingress-report-scheduler-delivers_18.html, now we will guide you on how to send personal Attendance Report to dedicated employee ...Overnight Flexi Hour Clocking Schedule in Ingress & TCMS V3

Introduction Flexi Clocking Schedule is a working schedule that does not include any late-ins, early outs or overtime. This is suitable for groups of workers where their working time is not fixed. Benefit The use of flexible working schedule ...